Vive's

Privacyverklaring

Bekijk onze privacyverklaring hieronder om te zien wat wij met jouw informatie doen.

Privacy & cookies

At Vive Invest, we care about the protection of your data and privacy and how it applies to you, as a user of our website(s). In this Privacy Policy ('Policy'), you can find information about how, whether, and why we collect and use your personal information on our Vive Invest website www.viveapp.com and on our mobile application Vive App. This Policy applies to any personal information that is gathered when you use our services, visit our Website, or otherwise interact with us. We have divided this Policy into different sections. The processing of your personal data complies with the General Data Protection Regulation (GDPR), the Dutch GDPR Execution Act and the Dutch Telecommunications Act.

About us

The data controller for the processing of your personal data is VIVE Invest B.V., registered at the Dutch Chamber of Commerce with registration number 62098896. Our address is Keizersgracht 268, 1016 EV Amsterdam, the Netherlands.

If you have any questions about the processing of personal data resulting after reading our Privacy Statement, you can contact us at privacy@viveapp.com.

Types of personal data we collect

To assess and open Vive Website and Mobile Application accounts, we can collect and use the following personal data:

- First and last name

- Date, country and place of birth

- Nationality

- Gender

- Residential address

- Telephone number

- Email address

- Social security numbers and/or other tax identification numbers

- Counter IBAN

- Device data (such as type of device, operating system, IP-addresses and advertising IDs)

- Location data via GPS

- Uploaded images/content

- Device data of added devices and API-keys

- Financial and banking data, product subscriptions and transaction history

- Cookies and usage date on how you use our products and services

- Correspondence with Vive Invest and support data (telephone, chat conversations and email)

- Additional information related to opening an account and creating your personalized investment

- Plans such as your knowledge and experience of financial markets, your financial situation, investment situation and preferences and your risk preferences

- Marketing data (statistics related to our marketing campaigns and data to measure this)

Information about our communication

- When you send us an email, or chat with us online or via social media, we save your correspondence with us if you are already a customer or in the process of becoming one or contacting us to find more about our products and/or services.

- Information we collect when you use our Website and/or our mobile application.

- When you visit our Website and mobile application or use our services, we may register your IP address, browser type, operating system, referring website, web-browsing behaviour.

- We may receive an automatic notification when you open (or open a link from) newsletters from us.

Information in relation to social media

Depending on your social network settings, we may receive information from your social network provider. For example, when you sign in for our services using a social network account, we may gather publicly available information you give us access to from your social network profile, including your contact details, interests, and social network.

For more information on the personal data that we receive from your social network provider, and how to change your privacy settings, please refer to the website and the privacy policy given by your social network provider.

Information you choose to share with us

You may also choose to share information with us. For example, when you leave a comment for us on Facebook, fill out a survey, submit a contact or application form, leave a review or submit an entry for a contest or scholarship, you have opted to share personal information with us.

You may also choose to share information with us. For example, when you leave a comment for us on Facebook, fill out a survey, submit a contact or application form, leave a review or submit an entry for a contest or scholarship, you have opted to share personal information with us.

Purposes of processing your data

Vive Invest processes your personal data in accordance with the laws and regulations based on several legal grounds. Vive Invest processes personal data to provide our services. For example, personal data is processed to:

- Comply with legal obligations

- To preserve our agreement and to provide our services in a secure manner, we process your personal data. For example, we need your contact information to keep you informed about relevant developments, and we store correspondence data to improve our customer services

- To make your user experience easier and more effective, we may assess how you use our services, and combine this data with information collected via your personal account, registration details, cookies, and similar technologies. This combination enables us to, for example, optimize our search algorithms and offer a better customer experience

- To create better and personaliszed investment strategies

- To process personal information for (direct) marketing purposes. This means we may use your personal information to send you newsletters, emails, promotions, or other marketing communications. We use the results of our analysis to tailor our marketing communications to your specific interests and preferences. For example, if our analysis shows that you may be interested in certain services, we may customize our newsletters and Website with content that is relevant to you. We may use different channels for our marketing communications, such as emails, social media, and your personal online account during different time frames and in recurrent manner.

- To initiate and evaluate business relationships. Your personal data will be processed for the entering into agreements and the performance thereof to the point of commercial services and the managing of the business relations which emerge from them, including the performance of activities aimed at the expansion of our client database.

Vive Invest is allowed to process personal data for this purpose because you gave consent or because Vive Invest has a legitimate interest. The consent can be withdrawn at any moment, and you can object at any moment to the processing of your personal data for direct marketing purposes. The withdrawal of consent or exercise of your right to object does not affect the lawfulness of the processing prior to the moment of withdrawal or exercise of the right to object.

You may object or revoke your consent for receiving marketing communications at any time, by following the instructions in the relevant marketing communication or by sending an email to privacy@viveapp.com

Legitimate and legal interests

In many cases, we are legally required to store certain data about you, for example to verify your identity, for research and to create personalized investment plans.

We can also process certain data when we have a legitimate interest to do so. For example, to prevent and combat misuse, to research and analyze the use of our products and services for marketing purposes, for information and system security or to share certain data with governmental institutions.

Disclosing or sharing data with third parties

General

We reserve the right to release personal information without your consent or without consulting you, when we deem it necessary to comply with our legal obligations, to enforce our terms and conditions, to protect the security of our Website and application, or to prevent fraud.

To be able to provide our services, we share certain personal data with third parties. We keep the sharing to a minimum and ensure these third parties will handle your personal data with the same care as we do. This means, among other things, we sign Data Processing Agreements. The third parties or categories of third parties with whom we share data are: Auth0, Onfido Limited, Online Payment Platform, Pipedrive, and Twilio.

Governmental institutions

To comply with laws and regulations we can share data with the concerned institutions. For example, the Tax Authorities can request financial data and we can share data with the Dutch Central Bank for participating in the Deposit Guarantee Scheme. Next to this, Vive Invest can have a statutory or legal obligation to share personal data with investigating authorities to prevent and combat misuse, fraud and crimes.

Security and retention

Vive Invest takes the safeguarding of your information very seriously. Vive Invest will take appropriate technical and organizational measures to protect your personal data against loss or unlawful use. These measures include but are not limited to: facilities protected by appropriate security measures, encryption of devices, version tracking and access to our databases is limited to key personnel and IP addresses and use of it is logged. Personal identifiable information and account activity are also protected through the use of user names and passwords. In order to help maintain the security of your information, you should protect the confidentiality of your user name and password.

How long we keep your personal data

We will hold all the data for so long as we have an obligation to the Customer to provide the Services, and thereafter until such time as we delete the Customer's account in accordance with our Customer Terms and Conditions.

Your personal information will be deleted on one of the following occurrences: - deletion of your personal information by you (or by another person engaged by the Customer); or - receipt of a written request by you (or another person engaged by the Customer) to us

For a large amount of data, we are legally obliged to retain this for a minimum of 5 to 7 years after ending the customer relationship. After this period, we don't store your personal data longer than legally allowed and no longer than necessary for the purposes the data was collected for.

We are able to store personal data for longer periods with a valid legal ground, or when the data is sufficiently (for example) pseudonymised or anonymised.

Your Rights

You can request access to or a copy of your personal data collected by us. You may also request the rectification and removal of personal data or the restriction of the processing of your personal data, if there is a reason for doing so. You also have the right to data portability. You also have the right to object to a processing on grounds relating to your particular situation or against the processing of your personal data for direct marketing purposes. More information on your rights is available at: https://autoriteitpersoonsgegevens.nl.

To exercise your right(s), please send us an email at privacy@viveapp.com or mail us: VIVE Invest B.V., Keizersgracht 203, 1016 DS Amsterdam, The Netherlands.

Revoking & limiting consent

When you have provided us with permission to process personal data, or when we process your personal data based on legitimate interests, you are able to revoke this permission in an easy manner or ask us to limit the use of your data. Revoking your permissions does not mean that stored data is deleted.

Direct marketing & usage data

If you do not want your data to be used for direct marketing activities and analysis of the usage of our products and services, you can let us know via the VIVE app anytime. Next to this, our communication via email contains the possibility to unsubscribe from these messages.

GPS and image and content access

While using the VIVE app, you can provide permission to process location data. If you no longer want us to use location data, you can revoke these permissions easily. This permission is also offering the possibility to protect your account, sending, for example, notifications when there is a login from an unknown location. You'll find these settings in the VIVE app. You can revoke provided permissions at any given moment.

Images and content that you use to personalise your VIVE account can be easily changed in the VIVE app.

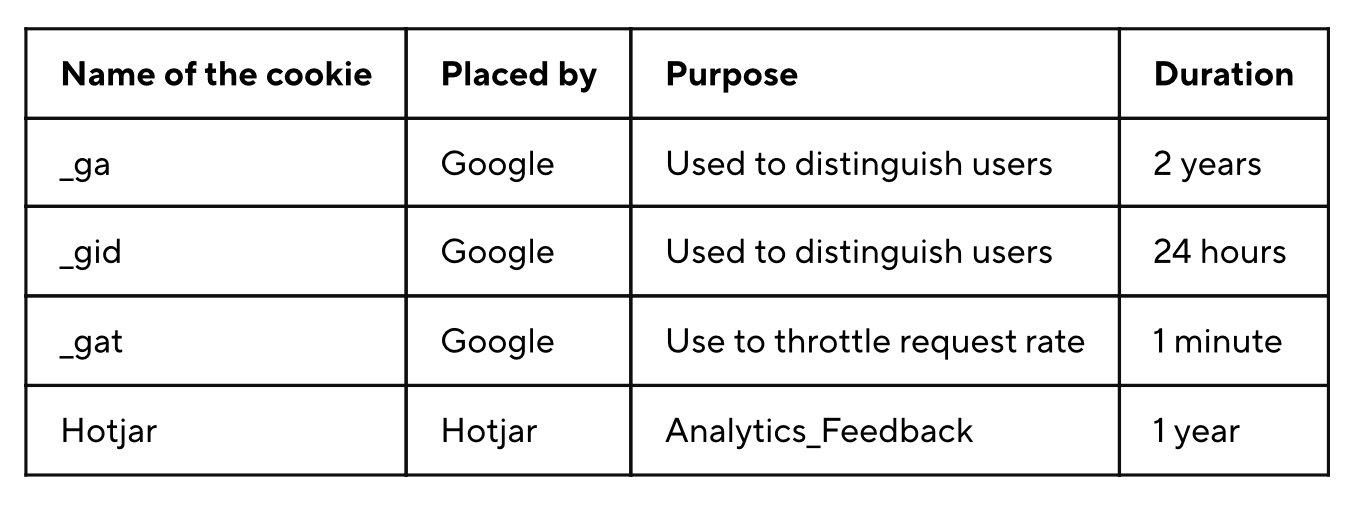

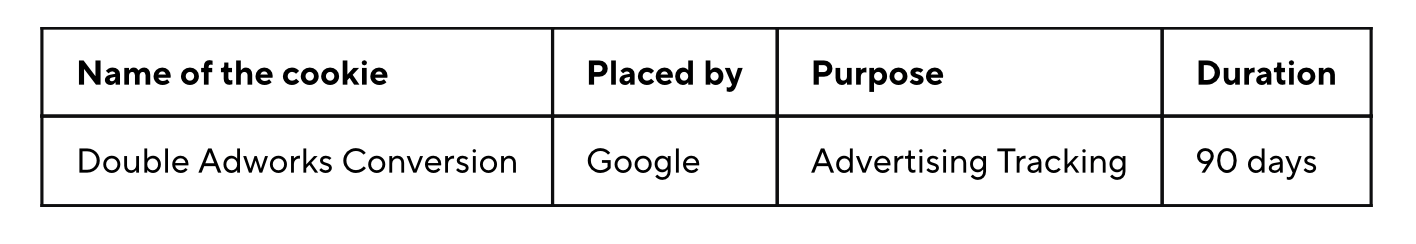

Cookies

For more information on how to delete cookies, please see our Cookie Statement.

Modifications to this Policy

This Policy is effective as of 23 of October 2018. We reserve the right to alter or otherwise make changes to this Policy. Notices may be by email to the last email address you provided us, by posting notice of such change on our Site or the Optimizely Service, or by other communication channels. You consent to receiving notices in these ways. We reserve the right to determine the form and means of providing notifications to you, consistent with applicable law. Changes take effect as soon as the Policy is posted.

Questions or complaints

If you have any question or complaints about the processing, please send an email to us at privacy@viveapp.com . If you feel that your rights have been violated, you may also make a complaint with the Autoriteit Persoonsgegevens, the Dutch Data Protection Authority (www.autoriteitpersoonsgegevens.nl). For more information on the protection of personal data, please consult the website of the Autoriteit Persoonsgegevens.

Contact Us

If you have any questions about this Privacy Policy or our privacy practices, please contact us at privacy@viveapp.com

Wat jammer dat je overweegt ons te verlaten. We willen je bedanken voor het gebruiken van onze app!

Wat moet je doen?

Als je ervoor kiest om je Vive-account te sluiten, kun je dit eenvoudig regelen via de Vive App.

In het menu vind je de optie 'Account sluiten'. Zodra we je verzoek ontvangen, blokkeren we je account en sturen we je een bevestiging zodra alles is afgehandeld.

Zorg ervoor dat je je geld hebt opgenomen voor je het account sluit en je opgebouwde pensioen is overgedragen naar een andere aanbieder.

Wat gebeurt er nadat mijn account is opgezegd?

Na het sluiten van je Vive-account, worden je gegevens volgens de AVG verwerkt: Persoonlijke gegevens van financiële instellingen worden 5 - 7 jaar bewaard volgens de ‘MiFID2’-richtlijn en daarna volledig verwijderd.

Kun je niet (meer) inloggen op je Vive-account? Heb je binnen 2 weken geen bevestigingsmail ontvangen? Stuur dan een e-mail naar support@viveapp.com met het e-mailadres waarmee je je hebt aangemeld.

Aanvullende voorwaarden lijfrente

Vive Invest B.V.

De onderstaande aanvullende voorwaarden gelden als u fiscaal belegd (lijfrente beleggen).

1. Voorwaarden voor Lijfrente beleggen

1.1 Deze Voorwaarden gelden alleen als u gebruikmaakt van fiscaal vriendelijk beleggen. Dit wordt vaak aangeduid als een lijfrente. Deze voorwaarden gelden naast de voorwaarden voor vermogensbeheer. Deze aanvullende voorwaarden noemen wij Lijfrente Voorwaarden.

De Lijfrente Voorwaarden zijn in overeenstemming met de op dit moment toepasselijke fiscale wet- en regelgeving, waaronder de Wet inkomstenbelasting 2001. Veranderen de fiscale regels? Dan passen we automatisch deze voorwaarden, maar uitsluitend voor zover nodig om te voldoen aan de fiscale regels.

1.2 Een Lijfrenterekening bij Vive Invest mag alleen worden gebruikt voor pensioenopbouw. De lijfrenterekening is een zogenaamd opbouwproduct.

1.3 De Lijfrenterekening is niet bedoeld voor pensioenuitkeringen. Daarvoor heeft u een uitkeerproduct nodig. Voor uw pensioendatum moet u kiezen waar u een uitkeerproduct wilt kopen. Dat kan bij een andere aanbieder. Het opgebouwde pensioen wordt dan gebruikt om op vaste momenten geld uit te keren. Zo ontvangt u iedere periode een bepaald bedrag. Hoeveel dat is hangt af van hoeveel u pensioenvermogen heeft opgebouwd.

1.4 Let op! U mag zelf beslissen hoeveel u stort op uw Lijfrenterekening. Maar als u meer stort dan uw jaarlijkse ruimte dan heeft dat fiscale gevolgen. Lees meer over de fiscale ruimte en wat dat is op www.belastingdienst.nl. Vive Invest controleert niet of u minder of meer dan uw fiscale ruimte aan inleg stort. Vraag hierover advies aan uw fiscaal of financieel adviseur.

1.5 Het ingelegde bedrag kunt u, zolang dat past binnen de regels van de Wet inkomstenbelasting 2001, aftrekken bij uw belastingaangifte. Vraag hierover advies aan uw fiscaal of financieel adviseur.

2. Wat is fiscaal beleggen?

2.1 Fiscaal beleggen betekent dat u vermogen opbouwt voor de oude dag. Het is niet de bedoeling om tussentijds geld op te nemen. De beleggingen vinden plaats via een beleggingsrekening die specifiek is bedoeld voor uw pensioen. Dit noemen wij de Lijfrenterekening. Deze rekening valt in box 1. Meer over fiscaal beleggen vindt u op de website van de Belastingdienst www.belastingdienst.nl.

3. Wie kan fiscaal beleggen?

3.1 Het openen van een Lijfrenterekening is uitsluitend mogelijk voor een particulier die:

(i) 18 jaar of ouder is;

(ii) Niet handelt in de uitoefening van een beroep of bedrijf;

(iii) In Nederland woont en daar belasting betaalt; en,

(iv) De rekening alleen gebruiken om pensioen op te bouwen als u te weinig pensioen heeft.

3.2 De Lijfrenterekening staat op naam van één persoon. Die persoon is de rekeninghouder. U zelf dus. Een en/of Lijfrenterekening is dus niet mogelijk.

4. Vraag fiscaal advies aan!

4.1 Vraag fiscaal advies aan voordat u fiscaal gaat beleggen. Wij geven daarover geen advies.

5. Wanneer en hoe ontvang ik mijn pensioen?

5.1 Om het geld op uw Lijfrenterekening te ontvangen, moet u een uitkeringsproduct kiezen. Dit kunt u doen bij een andere aanbieder.

5.2 De uitkeringsfase vangt aan uiterlijk op 31 december van het vijfde kalenderjaar na het jaar waarin u met pensioen mag. Houd hiermee rekening als u een uitkeringsproduct afsluit. Vive Invest biedt geen uitkeringsproduct aan.

6. Kan ik tussentijds geld opnemen?

6.1 U mag tussentijds geld opnemen van uw Lijfrenterekening. Maar dat is niet verstandig omdat u een soort boete moet betalen aan de Belastingdienst. U gebruikt namelijk het geld dat u opneemt dan niet voor uw pensioen en juist daarvoor gelden de belastingvoordelen.

6.2 Wilt u toch geld opnemen? Stuur dan een verzoek aan Vive Invest. Wij zullen dan het opgenomen bedrag overmaken naar uw tegenrekening. U rekent zelf af met de Belastingdienst.

7. Wat gebeurt er bij overlijden?

7.1 Uw erfgenamen moeten ons zo spoedig mogelijk informeren over uw overlijden. Wij hebben ook bewijs van uw overlijden nodig, bijvoorbeeld een kopie van een overlijdensakte.

7.2 Na uw overlijden mogen uw erfgenamen binnen de wettelijke beslistermijn gebruiken voor een nabestaandenlijfrente. Uw erfgenamen kunnen dat bij ons doen. Deze termijn eindigt op 31 december van het tweede kalenderjaar na het jaar van overlijden. Als dat niet op tijd gebeurt, dan ziet de Belastingdienst dit als afgekocht. Uw erfgenamen moeten dan afrekenen met de Belastingdienst.

7.3 Tussen het moment van overlijden en het moment waarop de erfgenamen het geld gebruiken voor een nabestaandenlijfrente bij Vive, geldt het volgende:

(i) Er is geen stortingsverplichting van uw erfgenamen; en,

(ii) Het saldo dat op het moment van overlijden aanwezig is op de Lijfrenterekening blijft onder beheer van Vive Invest totdat uw erfgenamen bij Vive Invest aangeven dat zij iets anders willen. Vive Invest zal tot dat moment het beheer van de beleggingen doorzetten volgens de voorwaarden zoals die met u zijn overeengekomen voorafgaand aan het overlijden. Erfgenamen kunnen Vive Invest schriftelijk vragen om het beleggingsbeleid aan te passen.

7.4 Zijn er erfgenamen? En wil iedere erfgenaam een uitkeringsrekening? Dan moet een uitkeringsproduct worden gekozen bij een andere aanbieder. Vive Invest doet dit niet.

8. Fiscale zaken die u moet weten

8.1 Als u te veel inlegt, het geld niet op tijd gebruikt of te vroeg opneemt, moet u misschien belasting betalen. U bent zelf verantwoordelijk voor hoe u dit fiscaal regelt. Vive Invest verstrekt geen advies en is voor uw belastingzaken niet verantwoordelijk.

Wij beheren uw vermogen

1. U heeft vermogensbeheer bij ons. Dit betekent dat u ons opdracht geeft om voor u te beleggen. Dat doen wij op basis van de afspraken die wij met u maken, bijvoorbeeld om pensioen op te bouwen. Die afspraken staan in uw beleggingsplan. U hoeft dus zelf geen effectenorders op te geven. Worden uw Beleggingen meer waard? Dan is de winst voor u. Worden uw Beleggingen minder waard? Dan is het beleggingsverlies ook voor u.

U informeert ons

2. U heeft ons informatie gegeven over uw persoonlijke omstandigheden waaronder uw doelstelling. Wij houden daar rekening mee als wij voor u beleggen. Veranderen uw persoonlijke omstandigheden? Dan moet u ons dat zo snel mogelijk laten weten. Doet u dat niet? Dan moet u rekening houden met financiële teleurstellingen.

Uw beleggingsplan

3. U heeft met ons een beleggingsplan afgesproken. Hierin staat hoe en met welke risico’s wij voor u beleggen. Ook staat in dit plan waarin wij voor u beleggen. Dit plan voeren wij voor u uit. In de Vive App ziet u precies hoe wij beleggen en met welk resultaat.

Bewaarinstelling

4. U heeft een Beleggingsrekening. Op deze rekening staan uw Beleggingen (en geld) bij Vive Custody B.V. geadministreerd. Deze B.V. bewaart en administreert uw Beleggingen. Hoe dit precies werkt en wat dit betekent staat in het Reglement bewaarinstelling Vive Custody B.V. Belangrijk is dat uw Beleggingen en geld veilig zijn als Vive failliet gaat.

Toestemming (volmacht)

5. U geeft aan ons toestemming om uw Beleggingsrekening te gebruiken om voor u te beleggen. Controleer altijd uw Beleggingsrekening en de informatie die wij u geven. Doet u dat niet? Dan kunnen wij u misschien niet helpen als er bijvoorbeeld iets mis is gegaan.

Belangrijke informatie

6. Alle belangrijke informatie over ons vermogensbeheer staat in dit contract en wat daarbij hoort. U heeft van ons ontvangen en gaat akkoord met:

a) algemene voorwaarden vermogensbeheer;

b) aanvullende voorwaarden lijfrente;

c) het Beleggingsplan dat u met ons afspreekt;

d) het Reglement Bewaarinstelling Vive Custody B.V.

Onze fee

7. U betaalt voor ons vermogensbeheer. Welke kosten dat zijn leest u in ons tarievenoverzicht op onze website.

Reglement Bewaarinstelling

Vive Custody B.V.

1. Hoe werkt de Bewaarinstelling van Vive Invest?

1.1 Hieronder leggen wij uit hoe de Bewaarinstelling Vive Custody B.V. (“Bewaarinstelling”) werkt. Deze Bewaarinstelling hoort bij Vive Invest maar is juridisch apart gezet in een B.V. Dat doen wij om uw Effecten en gelden veilig te stellen als Vive Invest onverhoopt failliet gaat. Dat moet ook van de wet.

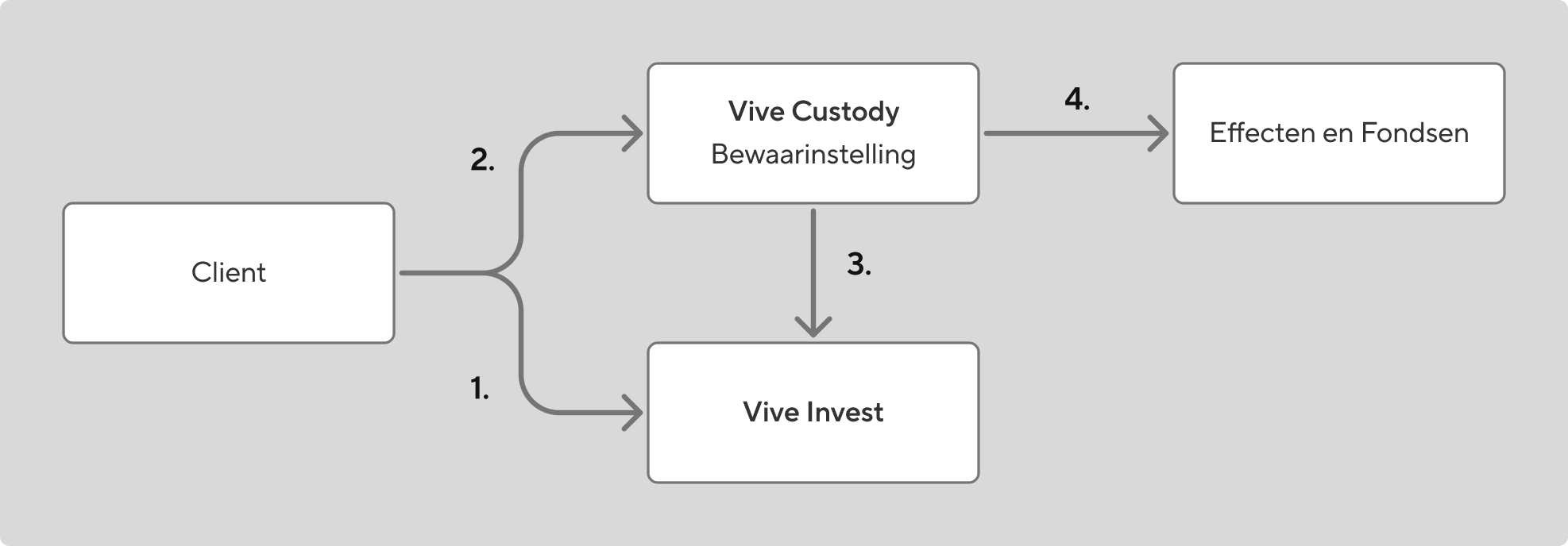

1.2 In de onderstaande tekening staat wie wat doet. Onderaan de tekening staat een uitleg

Uitleg:

- U heeft een vermogensbeheerovereenkomst gesloten met Vive Invest.

- U heeft een overeenkomst gesloten met Vive Invest en de Bewaarinstelling op grond waarvan de Bewaarinstelling de juridisch gerechtigde is en u economisch gerechtigde bent tot de financiële instrumenten. De Bewaarinstelling administreert en neemt de Effecten op eigen naam, maar ten behoeve en voor rekening en risico voor u in bewaring. U verkrijgt een vordering luidende in Effecten op de Bewaarinstelling.

- De Bewaarinstelling bewerkstelligt dat Vive Invest voldoet aan de regels van vermogensscheiding: in geval van faillissement van Vive Invest, behoren de beleggingen niet toe aan de boedel van Vive Invest.

- De Bewaarinstelling koopt (ten behoeve van u) direct Effecten aan in bepaalde Fondsen of uitgevende instellingen.

2. Uw afspraken met de Bewaarinstelling

2.1 Dit Reglement bevat de afspraken die gelden tussen u, Vive Invest en de Bewaarinstelling.

2.2 De afspraken tussen u en Vive Invest staan in de Klantovereenkomst (en de daarin vermelde voorwaarden en documenten). Dit Reglement hoort bij de Klantovereenkomst.

2.3 Vive Invest garandeert dat de Bewaarinstelling haar verplichtingen tegenover alle Klanten nakomt. Om die reden is Vive Invest partij bij dit Reglement.

3. Wat doet de Bewaarinstelling voor u?

3.1 Vive Invest maakt gebruikt van de Bewaarinstelling om uw vermogen van haar vermogen te scheiden. Gaat Vive Invest failliet dan blijven uw Beleggingen en de Effecten buiten het faillissement van Vive Invest.

3.2 Als Vive Invest voor u belegt, dan koopt of verkoopt de Bewaarinstelling Effecten.

3.3 De Bewaarinstelling doet dat alleen op verzoek van Vive Invest. De Bewaarinstelling beheert uw Beleggingen niet. Dat doet Vive Invest. Het geld dat Vive Invest voor u belegt komt van uw Beleggingsrekening.

3.4 De Effecten zijn (juridisch eigendom) van de Bewaarinstelling. De Effecten staan op naam van de Bewaarinstelling. De Bewaarinstelling heeft hiervoor een effectenrekening bij een bank.

De Bewaarinstelling doet dit ook voor andere Klanten. Op die rekening van de Bewaarinstelling bij de bank staan dus alle Effecten van alle Klanten van de Bewaarinstelling.

3.5 U krijgt Beleggingen. Dat zijn vorderingen op de Bewaarinstelling luidende in financiële instrumenten in de zin van de Wet op het financieel toezicht. Deze vorderingen luiden uitsluitend in hele Effecten.

3.6 De Bewaarinstelling zorgt ervoor dat al haar Effecten gelijk in waarde zijn aan alle Beleggingen.

3.7 Uw Beleggingen staan geadministreerd op de Beleggingsrekening die u aanhoudt bij Vive Invest.

3.8 U kunt niet de Bewaarinstelling vragen om aan- of verkoopopdrachten van Beleggingen. Dat kan alleen Vive Invest. Vive Invest doet voor u aan- en verkopen zoals is afgesproken in de Klantovereenkomst.

3.9 U kunt schriftelijk verzoeken om uitlevering van Beleggingen of Effecten bij de Bewaarinstelling of bij Vive Invest. Vive Invest brengt hiervoor een vergoeding in rekening.

4. Stemrecht

4.1 Uitgevende instellingen houden regelmatig – meestal één keer per jaar - een vergadering voor beleggers waarin kan worden gestemd. De Bewaarinstelling is juridisch eigenaar van de Effecten en heeft in die hoedanigheid een stemrecht. De Bewaarinstelling zal haar stemrecht in vergaderingen voor beleggers niet uitoefenen. U kunt als Klant via Vive Invest de Bewaarinstelling vragen om een stemvolmacht te verlenen zodat u zelf uw stem kunt uitbrengen met betrekking tot uw Effecten. Om gebruik te kunnen maken van deze stemvolmacht, dient u contact op te nemen met Vive Invest via support@viveapp.com.

4.2 De Bewaarinstelling is niet verplicht om het stemrecht op Effecten uit te oefenen.

5. Dividend

5.1 Keert een uitgevende instelling dividend/coupon uit in geld? Dan zal Vive Invest aan de Bewaarinstelling opdracht geven om dit dividend te herbeleggen conform uw beleggingsmandaat. De uit dit dividend verkregen Beleggingen worden dan bijgeschreven op uw Beleggingsrekening.

5.2 Keert een uitgevende instelling dividend/coupon uit in Effecten? Dan wordt dat dividend in de vorm van Beleggingen op uw Beleggingsrekening bijgeschreven.

5.3 Keert een uitgevende instelling naar keuze dividend/coupon uit in geld of Effecten? Dan zal Vive Invest aan de Bewaarinstelling opdracht geven te kiezen voor Effecten. De Beleggingen worden bijgeschreven op uw Beleggingsrekening.

6. Verantwoordelijkheid beleggingsverliezen en schade

6.1 De Bewaarinstelling is aansprakelijk voor de eventuele door u geleden schade, voor zover die schade het gevolg is van verwijtbare niet-nakoming van de op de Bewaarinstelling tegenover u rustende verplichtingen.

6.2 Vive Invest garandeert tegenover u dat de Bewaarinstelling haar afspraken uit dit Reglement nakomt.

6.3 De Bewaarinstelling en Vive Invest zijn niet verantwoordelijk voor schade die ontstaat doordat een uitgevende instelling haar afspraken niet nakomt tegenover haar eigen beleggers (waaronder de Bewaarinstelling).

7. Wanneer eindigt dit Reglement?

7.1 Dit Reglement (uw rechtsverhouding met de Bewaarinstelling) eindigt op hetzelfde moment als waarop de Klantovereenkomst tussen u en Vive Invest eindigt. Zegt u de Klantovereenkomst met Vive Invest op? Dan zegt u ook uw afspraken met de Bewaarinstelling op.

7.2 U kunt niet alleen dit Reglement (uw rechtsverhouding met de Bewaarinstelling) beëindigen; het is onderdeel van de Klantovereenkomst.

7.3 Als de Klantovereenkomst eindigt dan voert de Bewaarinstelling alle (eventuele) door Vive Invest gegeven opdrachten nog uit. Dat zijn lopende opdrachten of opdrachten die nodig zijn om het voor u gevoerde vermogensbeheer af te wikkelen. Daarbij blijven de afspraken uit dit Reglement geldig.

7.4 Als de Bewaarinstelling stopt, zoekt Vive Invest een vervanger. De Bewaarinstelling mag haar rechtsverhouding met u over laten nemen door een nieuwe vennootschap (contractsovername).

U stemt met deze vervanging en/of contractsovername, nu al in.

8. Veranderingen in en aanvullingen op het Reglement

8.1 De Bewaarinstelling mag dit Reglement op ieder moment helemaal of voor een deel veranderen of aanvullen. Een aanpassing gaat pas in als u daarover een e-mail hebt gekregen.

8.2 Is een verandering of aanvulling nadelig voor u? Dan gaat deze aanpassing pas in 1 maand nadat Vive Invest (namens de Bewaarinstelling) deze aanpassing bekend heeft gemaakt. Binnen deze maand kunt u de Klantovereenkomst met Vive Invest beëindigen. Hoe u dit doet, staat in de algemene voorwaarden.

Definities

In dit reglement maken wij gebruik van begrippen. Deze begrippen staan uitgedrukt met een hoofdletter.

- Beleggingen: Vorderingen van de Klant op de Bewaarinstelling, luidende in Effecten.

- Bewaarinstelling: De Bewaarinstelling Vive Custody B.V., statutair gevestigd te Amsterdam.

- Beleggingsrekening: Een Beleggingsrekening op naam van de Klant bij Vive Invest waarop beleggingen worden geadministreerd.

- Effecten: Financiële instrumenten die de Bewaarinstelling op eigen naam maar voor rekening van de Klant aanhoudt.

- Fondsen: Beleggingsinstellingen of andere instellingen waarin Vive Invest voor u belegt.

- Klant: Een klant die een Beleggingsrekening bij Vive Invest heeft geopend en een Klantovereenkomst met Vive Invest heeft gesloten.

- Vive Invest: Vive Invest is gevestigd te Amsterdam.

- Reglement: Het onderhavige Reglement Bewaarinstelling Vive Custody B.V.

- Klantovereenkomst: De overeenkomst op basis waarvan Vive Invest uw Effecten beheert (vermogensbeheer).

Inleiding SFDR Documentatie

Vive classificeert zichzelf als lichtgroen volgens de Sustainable Finance Disclosure Regulation (SFDR). Dit wordt ook wel een SFDR Artikel 8 classificatie genoemd. Lichtgroene beleggingsondernemingen zijn verplicht om de onderstaande informatie beschikbaar te stellen. Aangezien Vive geen modelportefeuilles levert maar wel informatie moet geven over specifieke portefeuilles, is de informatie gegeven voor drie 'voorbeeld' portefeuilles. Hierbij is het belangrijk om te benoemen dat het om een voorbeeld gaat gebaseerd op schattingen en dat de mate van verwezenlijken van de gepromote duurzame kenmerken afhangt van de specifieke parameters van een Vive beleggingsportefeuille.

Hieronder volgt per "voorbeeldportefeuille" de desbetreffende documentatie.

De Vive rendementsportefeuille

De Vive rendementsportefeuille is een modelportefeuille voor de Vive lijfrentebeleggingsrekening wanneer de pensionering van een pensioenbelegger nog meer dan 10 jaar in de toekomst ligt.

Artikel 10 (SFDR) Informatieverschaffing - De Vive rendementsportefeuille (link naar pdf download)

Artikel 8 (SFDR) pre-contractuele informatie - De Vive rendementsportefeuille (link naar pdf download)

De Vive afgebouwde pensioenportefeuille

De Vive afgebouwde pensioenportefeuille is een modelportefeuille voor de Vive lijfrentebeleggingsrekening wanneer de pensionering van een pensioenbelegger minder dan 1 jaar in de toekomst ligt.

Artikel 10 (SFDR) Informatieverschaffing - De Vive afgebouwde pensioenportefeuille (link naar pdf download)

Artikel 8 (SFDR) pre-contractuele informatie - De Vive afgebouwde pensioenportefeuille (link naar pdf download)

De Vive gebalanceerd risico portefeuille

De Vive gebalanceerd risico portefeuille is een modelportefeuille voor de Vive vermogensbeheerrekening wanneer een belegger een gebalanceerde risicopreferentie aangeeft voor een specifiek plan. Het gaat om precies te zijn om een risicopreferentie van 10% VaR. Dit is een veelvoorkomend vermogensbeheer portefeuille.

Artikel 10 (SFDR) Informatieverschaffing - De Vive gebalanceerd risico portefeuille (link naar pdf download)

Artikel 8 (SFDR) pre-contractuele informatie - De Vive gebalanceerd risico portefeuille (link naar pdf download)

Visie

Bij Vive gaat beleggen verder dan alleen financiële aspecten. Vive neemt duurzaamheidscriteria mee in het selectiebeleid. Hierbij streeft Vive naar het selecteren van beleggingsfondsen en managers die binnen hun categorie uitblinken op het gebied van duurzaamheid. Hierbij wordt duurzaamheid van twee kanten aangevlogen.

- Duurzaamheidsrisico’s (Outside-in): Vive analyseert de duurzaamheidsrisico’s die van invloed kunnen zijn op de prestaties van beleggingen, zoals milieuproblemen, sociale risico’s en gebrekkig ondernemingsbestuur. Deze worden kortweg aangeduid als ESG-factoren: Environment (milieu), Social (mens en maatschappij) en Governance (behoorlijk bestuur). Deze risico’s integreren we in ons beleggingsproces om weloverwogen selectiebeslissingen te nemen die de robuustheid van onze portefeuilles vergroten.

- Duurzaamheidsimpact (Inside-out): Vive heeft geen doelstelling voor duurzame beleggingen maar bevordert sociale kenmerken door middel van het selectiebeleid. Dit doet Vive op basis van de kaders uit de Sustainable Finance Disclosure Regulation (SFDR), de Europese wetgeving die transparantie rondom duurzaamheid bevordert.

Door duurzaamheidsrisico’s te beheersen met ESG-integratie, versterken we onze risico-rendementsverhouding en ondersteunen we onze langetermijndoelstellingen.

Toepassing van duurzaam beleggen

Vive heeft geen specifieke duurzaamheidsdoelstellingen geformuleerd maar promoot sociale kenmerken. Vive selecteert beleggingsfondsen op basis van een selectiebeleid, waar rekening wordt gehouden met duurzame karakteristieken, met als doel een gebalanceerde risico-rendementsverhouding. De selectiecriteria op basis van duurzaamheid zijn gebaseerd op de volgende principes:

- Uitsluitingsbeleid: Vive belegt alleen in fondsen die actief beleggingen uitsluiten op basis van een gestructureerd uitsluitingsbeleid, indien dit mogelijk is binnen de beleggingscategorie.

- Best-in-Class Selectie: Vive belegt alleen in fondsen die binnen hun beleggingscategorie en mandaat uitblinken op duurzaamheid aan de hand van ESG-prestaties en die in lijn met de SFDR-criteria ESG-doelen promoten of positieve impact maken. Om dit te garanderen selecteert Vive alleen fondsen met:

- Minimaal MSCI ESG rating BBB

- Minimaal SFDR artikel 8 classificatie, met een voorkeur voor artikel 9 fondsen

- Stemrechten en Engagement: Vive belegt alleen in fondsen die hun stemrechten actief uitoefenen en een duidelijke engagement strategie hanteren om verbeteringen in duurzaamheidsaspecten te stimuleren. Dit is alleen relevant voor aandelenfondsen.

- Sociale kenmerken: Vive promoot sociale kenmerken door alleen in beleggingsfondsen te beleggen waarvan:

- minder dan 0,5% van de portefeuille wordt belegd in bedrijven met een directe of indirecte betrokkenheid met controversiële wapens.

- minder dan 0,5% van de portefeuille wordt belegd in bedrijven die ten minste 5% van hun omzet uit tabaksproductie halen of ten minste 15% uit de combineerde omzet van tabaksdistributie, -levering of -detailhandel halen.

- minder dan 0,5% van de portefeuille wordt belegd in bedrijven die direct betrokken zijn met zeer aanhoudende controverses. Deze controverses kunnen te maken hebben met milieu, klanten, mensenrechten, arbeidsrechten of bestuur en worden vastgesteld met behulp van “MSCI ESG Controversies” methodologie.

- minder dan 0,5% van de portefeuille wordt belegd in bedrijven die in overtreding zijn van de UN Global Compact (UNGC)-principes.

Voor staatsobligaties wordt de minimale SFDR classificatie niet standaard toegepast, omdat deze doorgaans minder goed meetbaar zijn zoals bij andere beleggingscategorieën.

Met dit beleid verzekeren we dat onze beleggingen niet alleen voldoen aan financiële eisen, maar ook bijdragen aan duurzame en maatschappelijke waarde, passend bij de voortdurende ontwikkeling van duurzaamheidsstandaarden en regelgeving.

Overzicht per criterium

1. Duurzaamheidsrisico’s & ESG-Ratings

Duurzaamheidsrisico’s

Een duurzaamheidsrisico is een gebeurtenis of omstandigheid op het gebied van Environment (milieu), Social (mens en maatschappij) of Governance (behoorlijk bestuur) die mogelijk een negatieve invloed kan hebben op de waarde van een belegging. Voorbeelden van dergelijke risico’s zijn:

Milieurisico’s: Klimaatverandering kan de waarde van beleggingen in CO₂-intensieve sectoren verminderen, omdat het businessmodel van deze bedrijven op termijn mogelijk niet houdbaar is.

Sociale risico’s: Slechte arbeidsomstandigheden of mensenrechtenschendingen kunnen de reputatie van een onderneming schaden, met negatieve gevolgen voor de bedrijfsresultaten.

Bestuurlijke risico’s: Gebrek aan behoorlijk bestuur, zoals corruptie of onvoldoende risicobeheersing, kan leiden tot operationele en financiële problemen.

ESG-Ratings

ESG-Ratings meten hoe goed een bedrijf omgaat met financieel relevante duurzaamheidsrisico’s en -kansen. Deze beoordelingen worden gebruikt om binnen sectoren leiders en achterblijvers te identificeren op basis van:

- Hun blootstelling aan ESG-risico’s.

- Hun vermogen om deze risico’s effectief te beheren in vergelijking met concurrenten.

Vive gebruikt de MSCI ESG Ratings van MSCI om fondsen te beoordelen op het gebied van duurzaamheidsrisico’s. MSCI ESG-Rating zijn ontworpen om duurzaamheidsrisico’s kwantitatief inzichtelijk te meten, om te kunnen beoordelen in hoeverre een bedrijf bestand is tegen sector gebonden duurzaamheidsrisico’s. De MSCI ESG-Ratings worden gecategoriseerd als:

- Leiders: AAA, AA

- Gemiddeld: A, BBB, BB

- Achterblijvers: B, CCC

Deze ratings zijn toepasbaar op verschillende beleggingscategorieën, zoals aandelen, bedrijfsleningen en staatsleningen. Ook fondsen krijgen een rating, op basis van de rating van de onderliggende bedrijven waarin wordt belegd.

Wat doet Vive op het gebied van duurzaamheidsrisico’s en ESG-ratings?

Bij Vive integreren we de MSCI ESG-Ratings actief in ons beleggingsbeleid om duurzaamheidsrisico’s te beperken. Onze Best-in-Class aanpak richt zich op het selecteren van fondsen die binnen hun sector beter presteren op duurzaamheidsrisico-criteria dan hun vergelijkbare concurrenten. Wij maken gebruik van ESG-ratings als een belangrijke maatstaf binnen ons selectieproces. Deze ratings helpen ons om fondsen te identificeren die passen binnen de normen van ons beleid betreft duurzaamheidsrisico’s. Vive selecteert alleen maar fondsen met minimaal ESG rating BBB, waarbij we streven naar de hoogste scores binnen elk segment. De fondsen waar Vive in belegt scoren als volgt op basis van MSCI ESG ratings.

2. Beperking van negatieve impact (PAI)

Principal Adverse Impact (PAI) criteria

Een manier om duurzaam te beleggen is door beleggingen met negatieve impact op mens en milieu uit te sluiten. Om de negatieve gevolgen van beleggingen in kaart te brengen zijn de Principle Adverse Impact (PAI)-indicatoren opgesteld. Deze set van 64 meetbare indicatoren evalueert de mogelijke negatieve effecten van een belegging.

Voor beleggingsproducten die aangeven rekening te houden met ongunstige gevolgen van beleggingsbeslissingen op duurzaamheidsfactoren is het verplicht om over ten minste 18 van deze 64 PAI-indicatoren te rapporteren. Van deze 18 zijn 14 kernindicatoren die verplicht moeten worden gemeten voor alle relevante beleggingsproducten; daarnaast mogen 4 aanvullende indicatoren naar keuze worden opgenomen. De 14 verplichte indicatoren zijn:

- Broeikasgasemissies

- Koolstofvoetafdruk

- Broeikasgas-intensiteit van ondernemingen waarin is belegd

- Blootstelling aan ondernemingen actief in de sector fossiele brandstoffen

- Verbruik en opwekking niet-hernieuwbare energie.

- Intensiteit energieverbruik per sector met grote klimaateffecten

- Negatieve gevolgen voor biodiversiteitsgevoelige gebieden

- Emissies in water

- Gevaarlijk en radioactief afval ratio

- Schendingen van de UNGC en OECD richtlijnen

- Ontbreken van procedures en compliance mechanismen voor het monitoren van de naleving van de van de UNGC en OECD richtlijnen

- Niet-gecorrigeerde loonkloof tussen mannen en vrouwen

- Genderdiversiteit raad van bestuur

- Controversiële wapens

Wat doet Vive op het gebied van negatieve impact en PAI?

Vive neemt geen ongunstige effecten van haar beleggingsbeslissingen op duurzaamheidsfactoren in aanmerking.

Dit komt omdat Vive op dit moment alleen in niet-beursgenoteerde beleggingsfondsen belegt. In Vive’s huidige positie is het nog niet goed mogelijk om direct in te grijpen of gerichte maatregelen te nemen op het niveau van de onderliggende beleggingen in deze fondsen. Om deze reden kunnen wij geen specifieke negatieve effecten op duurzaamheidsgebied effectief beperken.

Wat Vive wel doet is het uitsluitend selecteren van fondsen met een gestructureerd uitsluitingsbeleid. Vive heeft geen specifieke uitsluitingen opgesteld die de onderliggende fondsen moeten hanteren.

Wat doen de onderliggende fondsen op het gebied van negatieve impact en PAI?

De onderliggende fondsen, waar Vive in belegt, rapporteren over de specifieke negatieve effecten (PAI-indicatoren) die zij door middel van hun eigen uitsluitingsbeleid beperken. Hieronder een overzicht van de negatieve effecten die de fondsen in elke beleggingscategorie van Vive beperken.

3. Positieve maatschappelijke en ecologische bijdrage (SFDR)

Sustainable Finance Disclosure Regulation (SFDR) classificaties

De SFDR biedt een Europees raamwerk voor het classificeren van beleggingen op basis van hun duurzaamheidsprestaties. Enkel beleggingen die voldoen aan de SFDR-vereisten voor ‘duurzame beleggingen’ mogen als zodanig worden bestempeld. Deze regelgeving verplicht financiële instellingen om transparant te rapporteren over hoe duurzaamheid wordt geïntegreerd in hun beleggingskeuzes en stelt beleggers in staat beter geïnformeerd te zijn over de duurzaamheid van beleggingsproducten. SFDR onderverdeelt producten in drie categorieën, gebaseerd op de mate waarin duurzaamheid een rol speelt:

- Artikel 6: Beleggingsproducten die duurzaamheid niet actief integreren en doorgaans geen specifieke informatie bieden over de aanpak van duurzaamheidsrisico’s binnen de beleggingsstrategie. Deze producten worden vaak aangeduid als “grijze beleggingen.”

- Artikel 8: Beleggingsproducten die rekening houden met de impact van beleggingen op ESG-criteria, zonder dat duurzaamheid de primaire focus hoeft te zijn. Deze fondsen kunnen duurzame beleggingsdoelen nastreven, maar dit is niet verplicht. Artikel 8 fondsen staan bekend als “lichtgroene beleggingen.”

- Artikel 9: Beleggingsproducten met een expliciete focus op duurzame doelstellingen, met als doel meetbare positieve impact op milieu, klimaat of sociaal gebied. Artikel 9 fondsen zijn gericht op diepgaande duurzaamheid en worden aangeduid als “donkergroene beleggingen.”

Dit classificatiesysteem helpt beleggers bij het onderscheiden van de duurzaamheidsprestaties van beleggingsproducten en biedt een gestandaardiseerde basis voor verantwoorde beleggingskeuzes.

Wat doet Vive op het gebied van positieve maatschappelijke en ecologische bijdrage & SFDR

Vive selecteert, waar mogelijk, alleen fondsen die ten minste voldoen aan SFDR artikel 8-criteria, met een sterke voorkeur voor artikel 9-fondsen. Deze classificaties zijn echter niet van toepassing op beleggingen in staatsobligaties. De selectiecriteria van Vive stellen geen minimum percentage in duurzame beleggingen conform SFDR maar gelden enkel voor de SFDR-classificatie van het fonds. Vive valt als beleggingsproduct zelf ook onder SFDR regelgeving en wordt geclassificeerd als een SFDR artikel 8 product. Hieronder een overzicht van de fondsen van Vive en de SFDR classificaties.

Wat doen de onderliggende fondsen op het gebied van positieve maatschappelijke en ecologische bijdrage & SFDR

Fondsen met een SFDR artikel 8 classificatie zijn niet verplicht om een minimum doelstelling aan duurzame beleggingen conform SFDR te hebben. Vive stelt hier ook geen minimum vereiste aan. Een deel van de fondsen waar Vive in belegt, heeft echter wel een minimum doelstelling voor deze duurzame beleggingen.

Hieronder volgt een overzicht van de doelstellingen van de fondsen waarin Vive belegt, evenals de gerapporteerde behaalde percentages duurzame beleggingen conform SFDR.

Wat is een duurzame belegging conform SFDR?

Fondsmanagers hebben intern beleid en methodologieën om te meten of een belegging duurzaam is conform SFDR. Er is geen uniform instrumentarium om belegging als duurzaam conform SFDR te classificeren. SFDR wetgeving schrijft voor dat een belegging duurzaam mag worden genoemd onder drie voorwaarden:

- De belegging moet een positieve bijdrage leveren aan een ecologische of maatschappelijke doelstelling.

- De belegging moet voldoen aan het “Do No Significant Harm” principe, wat inhoudt dat de belegging niet bijdraagt aan activiteiten die grote schade kunnen aanbrengen, zoals bijvoorbeeld controversiële wapens.

- Het bedrijf waar in wordt belegd moet voldoen aan normen voor goed bestuur ('good governance practices') met duidelijke regels om sociale problemen te voorkomen.

Als een fondsmanager bepaalt dat een belegging zich aan al deze 3 voorwaarden houdt, dan is het een duurzame belegging conform SFDR.

4. Ecologisch duurzame beleggingen (EU-Taxonomie)

EU-Taxonomie

en belegging wordt alleen als ecologisch duurzaam geclassificeerd door de EU-Taxonomie als de onderliggende activiteit significant en meetbaar bijdraagt aan ten minste één van de zes vastgestelde milieudoelstellingen. Daarnaast moet er ook met data worden aangetoond dat het bedrijf andere milieudoelstellingen niet significant schaadt (het “Do No Significant Harm” principe). Ook moet het bedrijf voldoen aan sociale maatstaven, zoals de bescherming van arbeidsrechten en het respecteren van mensenrechten.

De zes ecologische doelstellingen van de EU-Taxonomie zijn:

- Beperking van de klimaatverandering: Vermindering van de impact van het bedrijf op de opwarming van de aarde door bijvoorbeeld de uitstoot van broeikasgassen te verminderen.

- Aanpassing aan klimaatverandering: Maatregelen om de impact van klimaatverandering op de organisatie te beheersen door bijvoorbeeld dijken te bouwen als bescherming tegen overstromingen.

- Duurzaam gebruik en bescherming van water en mariene hulpbronnen: Het bevorderen van efficiënt watergebruik en de bescherming van waterkwaliteit.

- Transitie naar een circulaire economie: Het bevorderen van recycling, hergebruik en het verminderen van afvalproductie.

- Preventie en bestrijding van vervuiling: Het voorkomen en verminderen van lucht-, water- en bodemverontreiniging.

- Bescherming en herstel van biodiversiteit en ecosystemen: Het behoud en herstel van natuurlijke habitats en het voorkomen van verlies aan biodiversiteit

Wat doet Vive op het gebied van ecologisch duurzame beleggingen & de EU Taxonomie

Geen van de duurzame selectiecriteria van Vive hebben betrekking op duurzame beleggingen volgens de EU Taxonomie.

Wat doen de onderliggende fondsen op het gebied van ecologisch duurzame beleggingen & de EU Taxonomie

Geen van de onderliggende fondsen waar Vive in belegt heeft een doelstelling voor ecologisch duurzame beleggingen conform de EU Taxonomie.

Alleen het fonds Bedrijfsleningen Euro rapporteert achteraf ecologisch duurzame beleggingen van 1,06% (31/12/2023) conform de EU Taxonomie.

Doorlopende verbetering en aanpassing

Duurzaamheid is een onderwerp in voortdurende ontwikkeling. Bij Vive erkennen we dat de standaarden, wetgeving en inzichten rondom duurzaam beleggen zich blijven ontwikkelen. We blijven daarom ons duurzaamheidsbeleid continu aanscherpen en aanpassen aan de laatste ontwikkelingen. Dit stelt ons in staat om onze strategie voortdurend af te stemmen op de best practices binnen de sector.

Versiebeheer

Algemene Voorwaarden

Vive Invest B.V.

1. Met wie maakt u afspraken?

1.1 U maakt afspraken met VIVE Invest B.V. (Vive).

1.2 Vive heeft een vergunning van de AFM en is ingeschreven in het register van de AFM. De AFM en DNB houden toezicht op alle financiële instellingen, dus ook op Vive. Informatie over onze inschrijving in het AFM-register staat op de website www.afm.nl.

1.3 Ons adres is Keizersgracht 268 (1016 EV) in Amsterdam. Onze website is www.viveapp.com. We zijn bereikbaar per e-mail en via de chat op onze website of in onze app.

2. Wat doen wij voor u?

2.1 U heeft vermogensbeheer bij ons. Dat betekent dat wij voor u beleggen. U beslist dus niet zelf over uw Beleggingen. Dat doen wij voor u. Wij doen ons best om zo goed mogelijk voor u te beleggen. Maar het blijft uw geld. Worden uw Beleggingen meer waard? Dan is die winst voor u. Worden uw Beleggingen minder waard? Dan zijn de beleggingsverliezen ook voor u. Wij zijn daarvoor niet verantwoordelijk (aansprakelijk).

2.2 Hoe beslissen wij waarin wordt belegd? Dat doen wij op basis van de afspraken die u met ons heeft gemaakt. U spreekt met ons de hoofdregels om te beleggen af. Bijvoorbeeld hoeveel risico u wilt nemen. Deze afspraken staan in het Beleggingsplan. Wij beslissen dan waarin we voor u beleggen.

2.3 Wij sturen u steeds informatie over uw Beleggingen en over het vermogensbeheer. Het is belangrijk dat u die informatie leest. Zo weet u precies wat wij voor u doen.

2.4 Vinden wij dat het Beleggingsplan moet veranderen? Of vindt u dat? Dan maken we nieuwe afspraken.

2.5 Om voor u te beleggen, geeft u ons toestemming om uw Beleggingsrekening te openen en te gebruiken. Dat is een (administratieve) rekening die u krijgt bij de Bewaarinstelling, hierover leest u in artikel 7. Wij zullen alleen uw geld en Beleggingen gebruiken om te voldoen aan onze verplichtingen die volgen uit het met u afgesproken Beleggingsplan. Van het geld en deze Beleggingen maken wij een overzicht. Dat overzicht staat in uw persoonlijke omgeving in onze app.

2.6 U bent verplicht om de Vive app te installeren, te activeren en gedurende de looptijd van de overeenkomst te gebruiken. Zonder Vive app kunnen wij niet met u communiceren en beschikt u niet over informatie die voor u van belang is.

2.7 Wij verstrekken geen krediet. Dit betekent dat wij geen Beleggingen voor u aankopen als u daarvoor het geld niet heeft.

2.8 Wij spreken af dat u de Beleggingsrekening niet zelf gebruikt. U kunt ons dus geen beleggingsopdrachten geven.

3. Uw persoonlijke omstandigheden zijn belangrijk

3.1 U heeft ons informatie gegeven over uw persoonlijke omstandigheden. Uit uw persoonlijke omstandigheden blijkt of u het risico op verliezen kunt dragen. En of u die wilt dragen. Met deze informatie houden wij rekening bij het beleggen. U heeft ons bijvoorbeeld informatie gegeven over de volgende zaken:

a) Wat uw financiële positie is, wat uw inkomen en uw vermogen is.

b) Hoeveel u weet over beleggen en hoeveel ervaring u daarmee heeft.

c) Uw doelstelling. Daarmee bedoelen wij wat u precies wilt bereiken met het vermogensbeheer.

d) Welke risico’s u wel wilt nemen met beleggen en welke risico’s u niet wilt nemen.

e) Overige informatie over uzelf, zoals uw leeftijd, uw opleiding en uw werk.

f) Uw duurzaamheidsvoorkeuren (of en hoe u duurzaam wilt beleggen).

Sommige personen mogen van de wet of van het bedrijf waar zij werken niet altijd beleggen. Geldt dit voor u? Dan kunt u ons dit laten weten. Wij kunnen u hiermee helpen. Maar u bent er zelf verantwoordelijk voor dat u de wet of deze regels niet overtreedt.

3.2 Wij gaan ervan uit dat de informatie die u ons heeft gegeven over uw persoonlijke omstandigheden klopt. Ook mogen wij ervan uitgaan dat u ons de informatie heeft gegeven waar wij om hebben gevraagd. En dat u ook zelf de informatie geeft waarvan u weet dat deze belangrijk is voor ons. Bijvoorbeeld als u weet dat u al snel uw woning moet verkopen en u daardoor misschien een schuld overhoudt. Of als u gaat trouwen of scheiden.

3.3 Verandert er iets in uw persoonlijke omstandigheden? Of verwacht u dat er iets verandert?

En klopt daardoor de informatie over uw persoonlijke omstandigheden die wij van u hebben gekregen niet meer? Dan moet u ons dat zo snel mogelijk laten weten. Wijzigingen kunt u doorvoeren via uw persoonlijke omgeving in onze app. Dan beoordelen wij of we het Beleggingsplan moeten veranderen. Doet u dit niet of te laat? Dan zijn wij niet verantwoordelijk voor de gevolgen.

Stel, u gaat scheiden. Dan kan dat betekenen dat het Beleggingsplan moet veranderen. Geeft u niet aan ons door dat u gaat scheiden? Dan kan het zo zijn dat de Beleggingen die wij doen niet meer passen bij uw nieuwe persoonlijke omstandigheden en u bijvoorbeeld een beleggingsverlies niet meer kunt dragen.

3.4 Wij behandelen u als particuliere belegger. Wij zullen u dus niet behandelen als een professionele belegger. Ook niet als u daarom vraagt. Dat doen wij om u te beschermen. Professionele beleggers zijn bijvoorbeeld banken of (andere) vermogensbeheerders.

3.5 Indien uw persoonlijke omstandigheden wijzigen waardoor u wordt aangemerkt als US-person, bent u verplicht dit aan ons te melden. Wij zijn in dat geval genoodzaakt onze dienstverlening aan u te beëindigen.

U kunt meer informatie vinden of u een US-person bent op de website www.irs.gov.

Ingeval één of meer van onderstaande situaties op u van toepassing zijn, dient u ons hierover direct te informeren:

(i) u heeft een Amerikaans paspoort;

(ii) u bent geboren in de Verenigde Staten;

(iii) u woont in de Verenigde Staten; en,

(iv) u heeft een Amerikaans woon- of postadres.

4. Hoe voeren wij beleggingsopdrachten uit?

4.1 Wij hebben regels over hoe wij beleggingsopdrachten uitvoeren (orderuitvoeringsbeleid). Het orderuitvoeringsbeleid kunt u op onze website vinden.

4.2 Wij hebben als doel om voor u het best mogelijke resultaat te behalen. Deze regels zenden wij u toe met de overeenkomst en deze staan in uw persoonlijke omgeving in onze app.

5. U neemt risico als u belegt

5.1 Aan beleggen zijn risico’s verbonden. Een belegging kan minder geld waard worden.

Een belegging kan ook helemaal geen geld meer waard zijn. Er zijn verschillende soorten Beleggingen waarin wij kunnen beleggen. De belangrijkste informatie hierover vindt u ook op uw persoonlijke omgeving in onze app en op onze website www.viveapp.com.

Wilt u meer informatie? Laat het ons dan weten. Dan krijgt u die informatie van ons.

5.2 Begrijpt u uw Beleggingen niet meer? Of begrijpt u niet meer welke risico’s uw Beleggingen hebben? Dan moet u ons dat meteen laten weten. Wij geven graag uitleg.

5.3 U verklaart aan ons de volgende zaken:

a) U heeft van ons genoeg informatie ontvangen over welke risico’s horen bij welke Beleggingen. U heeft deze informatie gelezen. U heeft dit ook begrepen.

b) U begrijpt dat uw Beleggingen meer waard kunnen worden of minder waard kunnen worden. Hoeveel uw Beleggingen waard zullen worden, weet u nooit zeker. Als u in het verleden winst heeft gemaakt op uw Beleggingen, wil dat niet zeggen dat dit in de toekomst ook gebeurt.

U kunt dus ook verlies lijden. U begrijpt ook dat Beleggingen die kans hebben om extra veel waard te worden, ook extra veel kunnen dalen in waarde. U begrijpt dit niet alleen, maar u accepteert dit ook.

c) U begrijpt dat u een extra risico loopt als u geld leent en met dat geld belegt. Of als u geld heeft geleend en uw Beleggingen zekerheid zijn dat u de lening terugbetaalt. Uw Beleggingen kunnen minder geld waard worden. Of helemaal geen geld meer waard zijn. Dan moet u toch nog de lening terugbetalen. Of andere zekerheid geven als uw Beleggingen niet meer genoeg zekerheid zijn dat u de lening terugbetaalt. Wij raden af om met geleend geld te beleggen.

d) U belegt niet met geld dat u nodig heeft voor andere doeleinden.

6. Uw vergoeding voor ons beheer

6.1 U betaalt kosten voor het vermogensbeheer. Deze kosten worden geïncasseerd vanaf de Beleggingsrekening.

6.2 Deze kosten staan in ons kostenoverzicht, die te vinden is op onze website.

1) Een vaste vergoeding (beheerfee) per jaar. Deze vergoeding betaalt u in de eerste week van iedere maand. Wij incasseren dan de vergoeding over de nieuwe maand daarvoor. U betaalt dus achteraf. Met de beheerfee betalen wij onder meer onze operationele kosten, het bewaarkosten voor Vive Custody B.V., en kosten van toezicht door de AFM en DNB. Dit zijn kosten voor toezicht dat zij op ons houden. En een deel van de vaste vergoeding is voor onszelf.

2) Fondskosten die per portefeuille kunnen verschillen.

3) Eenmalige kosten voor incidentele gebeurtenissen, zoals bijvoorbeeld een waardeoverdracht bij een lijfrenteproduct.

6.3 De vaste vergoeding is afhankelijk van het geld en de waarde van uw Beleggingen op uw Beleggingsrekening.

6.4 Vive heeft het recht haar tarieven te wijzigen. In het geval van een verhoging heeft u het recht binnen dertig dagen na aankondiging van deze wijziging, de overeenkomst op te zeggen.

U bent nog wel de vergoeding over de maand verschuldigd waarin u opzegt.

6.5 U geeft ons toestemming om alle kosten die u aan ons verschuldigd bent automatisch af te schrijven van uw Beleggingsrekening.

6.6 Als het contract stopt dan berekenen wij de beheerfee pro rata tot en met de laatste dag van de maand waarin de overeenkomst eindigt.

7. Vive Custody B.V. bewaart uw Beleggingen

7.1 Wij gebruiken van een bewaarinstelling genaamd Vive Custody B.V. (hierna: “Bewaarinstelling”). De Bewaarinstelling is een aparte vennootschap. De Bewaarinstelling bewaart en administreert uw Beleggingen.

7.2 De Bewaarinstelling zorgt ervoor dat Vive voldoet aan de regels van vermogensscheiding: in geval van dat Vive failliet zou gaan, vallen uw Beleggingen niet in de boedel van Vive.

7.3 U sluit een aparte overeenkomst af met de Bewaarinstelling (en Vive). Deze overeenkomst noemen wij het Reglement Bewaarinstelling Vive Custody B.V. (hierna: “Reglement”). Dit Reglement regelt de verhouding tussen u, de Bewaarinstelling en Vive. U kunt dit reglement altijd vinden in uw persoonlijke omgeving in onze app en op onze website.

8. U mag stemmen

8.1 Bij sommige Beleggingen hoort het recht om een vergadering bij te wonen. Of om te stemmen.

De Bewaarinstelling is juridisch eigenaar van de Beleggingen en heeft in die hoedanigheid een stemrecht.

8.2 De Bewaarinstelling zal haar stemrecht in vergaderingen voor beleggers niet uitoefenen. U kunt als Klant de Bewaarinstelling schriftelijk vragen om een stemvolmacht te verlenen zodat u zelf kunt stemmen over uw beleggingen. Om gebruik te kunnen maken van deze stemvolmacht, dient u contact op te nemen met Vive via support@viveapp.com.

9. Hoe kunt u ons een bericht doorgeven?

9.1 Wilt u ons een bericht doorgeven? Dan kunt u dat op twee manieren doen:

1) We zijn bereikbaar via de chat op onze website of in de app.

2) U stuurt een e-mail naar support@viveapp.com.

9.2 Geeft u toch op een andere manier een bericht aan ons door? Bijvoorbeeld per fax? Of per post? En ontstaan daardoor bijvoorbeeld misverstanden? Of vertragingen? Dan is dat uw risico. U kunt aan ons geen beleggingsopdrachten geven.

10. U geeft toestemming voor verwerking van persoonsgegevens

10.1 U gaat er mee akkoord dat wij uw (persoon)gegevens opnemen in onze klantregistratie.

Deze persoonsgegevens omvatten onder andere uw naam, adres en woonplaatsgegevens, en de overige gegevens welke bij of naar aanleiding van deze overeenkomst zijn verstrekt.

10.2 Vive zal deze gegevens vertrouwelijk behandelen en deze niet aan derden ter beschikking stellen, behalve in de volgende gevallen:

1) het nodig is om transacties uit te voeren die horen bij deze overeenkomst;

2) om te voldoen aan wettelijke verplichtingen.

10.3 Op de verwerking van de persoonsgegevens is de Algemene verordening gegevensbescherming (AVG) van toepassing.

11. U geeft toestemming voor elektronische informatie

11.1 U krijgt van ons informatie over het vermogensbeheer. U geeft ons toestemming om deze informatie elektronisch aan u te versturen. Bijvoorbeeld per e-mail. Of naar uw persoonlijke omgeving in onze app.

11.2 Wij verwachten van u en gaan ervan uit dat u regelmatig uw persoonlijke omgeving in onze app in de gaten houdt, zodat u geen belangrijke informatie mist.

11.3 Informatie die niet voor u persoonlijk bedoeld is, staat op onze website www.viveapp.com.

Die informatie hoeven wij dus niet nog apart aan u te versturen. Dat mag wel.

12. Wij hebben regels over belangenconflicten

12.1 Wij hebben regels over hoe wij voorkomen dat wij een belangenconflict hebben met onze Klanten of dat onze Klanten onderling een belangenconflict hebben. Of een belangenconflict bij onszelf, bijvoorbeeld met bedrijven die bij ons horen.

12.2 Is er toch een belangenconflict? Dan hebben wij ook regels hoe wij omgaan met dit belangenconflict. Al deze regels vindt u op onze website www.viveapp.com. Wilt u meer informatie? Laat het dan weten. Dan geven wij u meer informatie.

13. U bent verantwoordelijk

13.1 De risico’s van het vermogensbeheer zijn helemaal voor u. Als uw Beleggingen minder waard zijn geworden en u verkoopt uw Beleggingen, dan ontvangt u dus minder geld. Daarvoor zijn wij niet verantwoordelijk (aansprakelijk). Wanneer wij wel verantwoordelijk zijn, leest u in artikel 16.

13.2 Ook bent u verantwoordelijk om veranderingen in uw persoonlijke omstandigheden meteen aan ons door te geven (zie artikel 3 van deze algemene voorwaarden).

14. Wij geven u informatie

14.1 Wij geven u informatie over het vermogensbeheer en de ontwikkeling van uw Beleggingen.

14.2 Wij stellen in uw persoonlijke omgeving in onze app de volgende informatie beschikbaar:

a) Informatie over iedere beleggingsopdracht die wij hebben uitgevoerd. Dat kan een aankoop van een belegging zijn of een verkoop van een belegging. Hebben wij meerdere beleggingsopdrachten uitgevoerd? Dan sturen we die informatie in één keer. We doen dat uiterlijk 1 dag nadat de beleggingsopdracht is uitgevoerd.

b) Informatie over het vermogensbeheer dat wij voor u doen. Bijvoorbeeld over de waarde van uw Beleggingen op dat moment en welke Beleggingen u precies heeft. Wij sturen u die informatie elke 3 maanden toe. Ook sturen wij u informatie over de kosten.

c) Informatie over de manier waarop uw Beleggingen beantwoorden aan uw voorkeuren en doelstellingen en dus nog geschikt zijn voor u. Deze informatie verstrekken wij jaarlijks.

d) Informatie over een verlies van 10% van de totale waarde van uw portefeuille zoals bepaald aan het begin van elke rapportageperiode of een veelvoud daarvan. Wij sturen die informatie uiterlijk aan het einde van de dag waarop dit verlies is opgetreden. U stemt ermee in dat wij dus niet een 10% waardedaling van iedere belegging bij u melden maar alleen ingeval de totale waarde van uw portefeuille met 10% (of meer) daalt.

Al deze informatie krijgt u in uw persoonlijke omgeving in onze app.

15. Controleer altijd onze informatie

15.1 Heeft u informatie ontvangen? Bijvoorbeeld bevestigingen of overzichten? En is deze informatie onjuist? Of bent u het niet eens met een beleggingsopdracht die wij hebben uitgevoerd? Bijvoorbeeld omdat u vindt dat deze niet valt onder het Beleggingsplan? Dan moet u ons dat direct laten weten. Laat u ons dit niet binnen 5 dagen weten? Dan mogen wij ervan uitgaan dat de informatie en de bijbehorende beleggingsopdrachten die wij u hebben gegeven goed waren.

15.2 Indien u niet binnen 30 dagen nadat wij de kwartaalrapportage aan u ter beschikking hebben gesteld ons laat weten dat u het hiermee niet eens bent, gaan wij ervan uit dat u akkoord bent met het door ons gevoerde beheer gedurende die periode.

15.3 Verwacht u een bericht van ons of hoort u te weten dat u een bericht van ons zou moeten krijgen? Maar krijgt u dat bericht niet? Dan moet u ons dat zo snel mogelijk laten weten.

16. Wanneer zijn wij verantwoordelijk (aansprakelijk) en wanneer niet?

16.1 Heeft u schade? Komt die schade door ons beheer? En hebben wij hieraan ernstige schuld of komt dit door opzet van ons? Alleen dan zijn wij daarvoor verantwoordelijk en moeten wij betalen voor die schade.

16.2 Voor andere schade zijn wij dus niet verantwoordelijk. Bijvoorbeeld als u schade heeft in de volgende situaties:

1) Als uw schade nog andere schade tot gevolg heeft.

2) Als u de doelen die u heeft voor het vermogensbeheer niet haalt.

3) Als wij maatregelen moesten nemen die volgen uit de wet of van de toezichthouder, of door bijzondere omstandigheden.

17. Overmacht

17.1 Wij zijn niet verantwoordelijk voor schade als wij door overmacht niet kunnen doen wat wij moeten of hebben belegd. Wat is overmacht? Dat is bijvoorbeeld een storing in systemen, stroomuitval, brand, of andere omstandigheden die buiten onze macht liggen.

18. Wij kunnen onze afspraken met u veranderen

18.1 Wij mogen altijd onze afspraken met u veranderen. Bijvoorbeeld de regels die wij hebben gemaakt over hoe wij beleggingsopdrachten laten uitvoeren om voor u het best mogelijke resultaat te halen (orderuitvoeringsbeleid).

Wij zullen u dat laten weten via persoonlijke omgeving in onze app. Of we sturen u een brief of een e-mail. De verandering gaat meteen in. Of op een datum die wij hebben gekozen. Die datum is nooit in het verleden.

Uw Beleggingsplan wijzigen wij niet zonder overleg met u.

18.2 Is een verandering nadelig voor u? Dan gaat de verandering pas in 30 dagen nadat wij de verandering bekend hebben gemaakt. Bent u het niet eens met deze wijzigingen? Dan kunt u het contract stoppen. Hoe u het contract stopt, staat in artikel 19 van deze voorwaarden. Horen wij niets van u? Dan gaat u akkoord met die veranderingen.

18.3 Als een wet nieuwe eisen stelt aan onze overeenkomst waardoor de overeenkomst met ons moet veranderen, dan gaat die verandering meteen in. Daarvoor hebben wij geen toestemming nodig.

19. Wanneer stopt uw contract met ons?

19.1 Ons contract heeft geen einddatum.

19.2 U kunt het contract stoppen. Wij kunnen ook het contract stoppen. Dat kan iedere dag. Wel moet u en ook wij een opzegtermijn van een maand aanhouden. Dit gebeurt altijd tegen het einde van een opvolgende maand. Zolang er geld of Beleggingen op uw Beleggingsrekening staan, berekenen we op de laatste dag van de maand de vaste kosten die wij van u ontvangen.

19.3 In sommige situaties kunnen wij kiezen om het contract meteen of tijdelijk te stoppen. Geen opzeggingstermijn is dan vereist. Het gaat om de volgende situaties:

a) Als u uitstel van betaling aanvraagt (surseance van betaling);

b) Als uw faillissement wordt aangevraagd;

c) Als u een bedrijf bent en dat wordt ontbonden;

d) Als de schuldsaneringsregeling voor u geldt;

e) U overlijdt en wij een verklaring van erfrecht of executele ontvangen en daarbij het verzoek te stoppen met het beheer;

f) Als een curator of bewindvoerder over uw geld en Beleggingen beslist;

g) Als continuering van onze relatie niet meer mag van de wet, de rechter of onze reputatie ernstig schaadt;

h) Als u weigert medewerking te verlenen om Vive in staat te stellen te voldoen aan regelgeving; ter bestrijding van witwassen en andere financiële criminaliteit;

i) Als u een US-person bent; of

j) Als u verhuist naar een land dat is opgenomen op de sanctielijst van de Europese Unie.

Hebben wij ons werk voor u tijdelijk gestopt? Dan zullen we als dat kan met u, de curator of bewindvoerder overleggen of het contract moet stoppen.

19.4 Stopt het contract? Dan stoppen wij met beleggen voor u. Hadden we al een beleggingsopdracht uitgevoerd? Maar is die beleggingsopdracht nog niet helemaal afgerond? Dan zal die beleggingsopdracht nog wel worden afgerond.

Als het contract stopt, liquideren wij binnen twee weken uw portefeuille en storten wij het vrijgekomen geld op de voor ons bekende tegenrekening. Indien u nog een vergoeding dient te betalen aan ons, dan verrekenen wij dat eerst met de gelden op uw Beleggingsrekening. U mag beslissen hoe wij na het contract uw Beleggingen verkopen. U moet ons dat tijdig laten weten. Het moet wel eenvoudig uit te voeren zijn en binnen twee weken afgerond kunnen worden. Zegt u niets? Dan beslissen wij naar eigen inzicht. Dat kan betekenen dat wij alle Beleggingen meteen op 1 dag verkopen.

Als uw tegenrekening onjuist is of niet langer op uw naam staat en wij u na 6 maanden nog steeds niet kunnen bereiken om uw geld terug te storten, geeft u Vive toestemming om uw geld aan een goed doel te doneren.

20. Uitlevering

20.1 U kunt niet verzoeken om uitlevering van Effecten die de Bewaarinstelling aanhoudt.

21. Als wij failliet gaan

21.1 Wij vallen onder het beleggerscompensatiestelsel. De bank waarmee wij samenwerken valt ook onder het beleggerscompensatiestelsel.

21.2 Uw Beleggingen zijn gescheiden van Vive via de Bewaarinstelling. Wanneer wij failliet gaan, dan vallen uw Beleggingen en gelden buiten het faillissement van Vive. Uw Beleggingen en gelden worden bewaard door de Bewaarinstelling. U houdt in geval van faillissement van Vive uw aanspraak op de Bewaarinstelling.

22. Overlijden

22.1 Indien u als natuurlijk persoon de enige rekeninghouder bent of de enige bestuurder van de rechtspersoon bent en u komt te overlijden dan wordt (voor zover er nog niet in opvolging is voorzien) de strekking van het vermogensbeheer gedurende één jaar na het overlijden beperkt tot rechtshandelingen die – naar ons oordeel – niet zonder nadeel kunnen worden uitgesteld.

Dit betreft bijvoorbeeld het geven van opdrachten aan de depotbank tot het uitvoeren van orders die strekken tot het verkopen en sluiten van posities.

22.2 Eén jaar na het overlijden stopt het beheermandaat automatisch. Wij zullen binnen een redelijke periode voorafgaand aan dat moment uw posities verkopen of, indien van toepassing, sluiten en de opbrengsten stallen op de aan het depot gekoppelde tegenrekening.

23. Heeft u een klacht?

23.1 Heeft u een klacht of opmerking? Laat het ons dan weten. Hoe u dat kunt doen, staat in uw persoonlijke omgeving in de app en op onze website www.viveapp.com.

23.2 Heeft u van ons een antwoord gekregen op uw klacht? En bent u het daar niet mee eens? Dan kunt u binnen drie maanden uw klacht voorleggen aan het Klachteninstituut Financiële Dienstverlening (KiFiD), Postbus 93257, 2509 AG Den Haag. U kunt de klacht ook doorgeven via www.kifid.nl.

Op onze website vindt u meer informatie over het KiFiD.

U kunt met uw klacht ook naar de rechter gaan.

24. Nederlandse taal

24.1 Het contract met deze voorwaarden en alle andere informatie van ons over het vermogensbeheer zijn in het Nederlands.

24.2 Hebben wij informatie gekregen over Beleggingen die in het Engels is? Dan krijgt u die informatie ook in het Engels. Begrijpt u die informatie niet? Laat het dan weten. Dan leggen wij het u uit.

25. Het Nederlands recht geldt

25.1 Voor het contract en deze voorwaarden geldt het Nederlands recht.

25.2 De rechtbank in Amsterdam is bevoegd om eventuele geschillen tussen ons op te lossen door een vonnis uit te spreken.

Protocol Stroomlijning Kapitaaloverdrachten (PSK)

Wanneer je fiscaal vriendelijk pensioenvermogen hebt opgebouwd bij een andere aanbieder en je wenst dit vermogen over te boeken naar Vive (of omgekeerd) zonder onmiddellijke heffing van inkomstenbelasting, biedt het Protocol Stroomlijning Kapitaaloverdrachten (PSK) uitkomst. Dit document legt uit hoe je dergelijke overboekingen kunt regelen. Dit geldt ook voor overdracht van pensioenvermogen van Vive naar een andere aanbieder.

Vive Pensioenplan

Het pensioenplan van Vive omvat:

- Een persoonlijke lijfrenterekening.

- Een samengestelde beleggingsportefeuille.

- Een beleggingsstrategie.

De lijfrenterekening is geblokkeerd om onbedoelde opnames te voorkomen, die tot fiscale consequenties kunnen leiden, zoals de directe inhouding van inkomstenbelasting en mogelijk revisierente. De inleg op deze rekening kan fiscaal aftrekbaar zijn. Overboekingen van of naar een andere aanbieder, zonder directe inkomstenbelasting, zijn mogelijk onder bepaalde voorwaarden.

PSK

Vive is aangesloten bij het PSK om de overboeking van opgebouwd vermogen soepel en zonder directe fiscale gevolgen te laten verlopen. Dit protocol, ondersteund door het Verbond van Verzekeraars en de Nederlandse Vereniging van Banken, zorgt voor een 'fiscaal geruisloze' waardeoverdracht, waarbij niet direct met de Belastingdienst afgerekend hoeft te worden.

Voorkomen van inkomstenbelasting

Een waardeoverdracht moet nauwkeurig gebeuren, omdat de Belastingdienst anders belasting kan heffen over het opgebouwde kapitaal. Het Verbond van Verzekeraars en de Nederlandse Vereniging van Banken hebben daarom onderling afspraken gemaakt om een waardeoverdracht soepel te laten verlopen. Dit heet “fiscaal geruisloos”. Dat betekent dat de overdracht op een dusdanige wijze plaatsvindt dat er tussentijds niet afgerekend hoeft te worden met de Belastingdienst. Deze afspraken zijn vastgelegd in het PSK. De bij de PSK aangesloten partijen (zoals banken, verzekeraars en beleggingsinstellingen en ondernemingen) hebben procedures afgesproken met betrekking tot de waardeoverdracht van fiscaal gefaciliteerde producten naar een andere aanbieder. Vive is aangesloten bij het PSK en werkt volgens dit protocol.

Lees meer over het PSK op de website van de Nederlandse Vereniging van Banken (NVB) of op de website van het Verbond van Verzekeraars.

Advies over waardeoverdracht

Je bent zelf verantwoordelijk voor de keuze om waarde over te dragen van of naar Vive. Vraag eventueel een financieel adviseur om advies om te bepalen of het een verstandige keuze is om dit te doen. Waardeoverdrachten kunnen fiscale consequenties hebben op langere termijn.

Hoe werkt het?

a. Waardeoverdracht naar Vive

Download het formulier onderaan deze tekst. Onderteken deze en stuur deze in naar de huidige aanbieder. Zodra de huidige aanbieder het formulier en alle vereiste documenten heeft ontvangen, zet deze de waardeoverdracht in gang.

Hierna wordt de overdracht binnen veertien kalenderdagen uitgevoerd. Valt de veertiende dag in het weekend of op een feestdag? Dan geldt de eerstvolgende werkdag als de veertiende dag. Vive stuurt je een bericht zodra het geld door de overdragende PSK-deelnemer aan Vive is overgemaakt. De aanbieder die de waardeoverdracht uitvoert, kan kosten in rekening brengen.

b. Waardeoverdracht van Vive naar andere aanbieder

Mocht u besluiten om de waarde van uw pensioen beleggingsrekening (tussentijds) voort te zetten bij een andere PSK-aanbieder, dan meldt u dit in de chatfunctie van de Vive app of door te e-mailen naar support@viveapp.com. Vive stuurt hierop een e-mail met het overboekingsformulier en een toelichting op het formulier. Het formulier dient volledig ingevuld en ondertekend teruggestuurd te worden. Na ontvangst zal Vive binnen veertien dagen de overboeking tot stand brengen. De administratieve kosten die door Vive in rekening worden gebracht voor het overboeken van uw waarde naar een andere aanbieder bedragen: (nader te bepalen).

Aanvullende benodigde documenten

In sommige situaties zijn aanvullende documenten vereist, bijvoorbeeld wanneer er sprake is van een echtscheiding of overlijden. Zonder deze documenten mag Vive uw geld niet overboeken naar een andere aanbieder.

- Echtscheiding: Echtscheidingsconvenant.

- Overlijden: Akte van overlijden en verklaring van erfrecht.

- Volmacht: Bewijs van volmacht.

In geval de financiële instelling waarnaar u de waarde wilt overdragen niet deelneemt aan het PSK, dan heeft de overnemende financiële instelling van Vive een vrijwaringsverklaring nodig. Vive stemt deze vrijwaringsverklaring met de overnemende financiële instelling af.

Rentevergoeding

Bij overschrijding van de veertiendagen-periode voor waardeoverdracht is de overdragende partij verplicht wettelijke rente te vergoeden.

Volledig op maat

Alles wat wij doen is gebaseerd op jouw situatie, wensen en doelen.

Jouw ideale portefeuille

We stellen de ideale beleggingsportefeuille voor je samen die precies past bij je situatie, wensen en doelen.

Altijd aanpasbaar

Je kunt altijd en overal je plan

wijzigen of stopzetten, waar en wanneer je wilt.

Een plan dat perfect past.

Wij stellen een beleggingsportfolio voor je samen die perfect past bij jou en je doelen. Om een goed beeld te krijgen van wie je bent, stellen we je vooraf een aantal vragen. Ook brengen we je financiële situatie in kaart. We geven deze een score en noemen dit je financieel profiel. Op basis hiervan schatten we in welke risico’s je kunt nemen en welke stijl van beleggen het beste bij je past.

Vervolgens geef je aan waar je voor wilt beleggen. Bijvoorbeeld voor je huis, camperbusje of pensioen. Ook kun je zonder concreet doel je geld laten werken.

Dan voeren we dit plan voor je uit door je beleggingsstrategie uit te voeren. Je kunt er altijd voor kiezen om je plan aan te passen. Wij verwerken je nieuwe wensen direct in je strategie. Wil je minder risico nemen? Dan zorgen wij ervoor dat we veiligere beleggingen voor je inkopen. Wil je minder inleggen per maand, maar wel net zoveel rendement? Dan gaan we gedurfder voor je beleggen.

Je kunt altijd precies zien uit welke beleggingen je portefeuille bestaat. Je vindt dit in de app bij plannen > jouw plan > portefeuille.